Sollex awarded with Star Business Awards [2025]

Sollex has been awarded the Star Business Awards 2024 and 2025

2025-03-18

Sollex AB has been awarded Star Business Awards 2025!

The Star Business Awards recognize the best companies in Sweden based on profitability and growth over a certain period of time. Indicators such as brand and market position, strategic decisions and innovation, leadership and corporate culture are also evaluated. Sollex was selected by the company for meeting the required criteria and received the Star Business Awards 2025.

The Star Business Awards recognize the best companies in Sweden based on profitability and growth over a certain period of time. Indicators such as brand and market position, strategic decisions and innovation, leadership and corporate culture are also evaluated. Sollex was selected by the company for meeting the required criteria and received the Star Business Awards 2025.

We are very grateful for this award and would like to thank our wonderful partners and best customers for their trust and cooperation.

The Star Business Awards aim to honor and highlight the country's talented and outstanding entrepreneurs. At the same time, it recognizes companies that stand out in the industry, especially in terms of economy, quality and innovation, among others.

2024-10-15

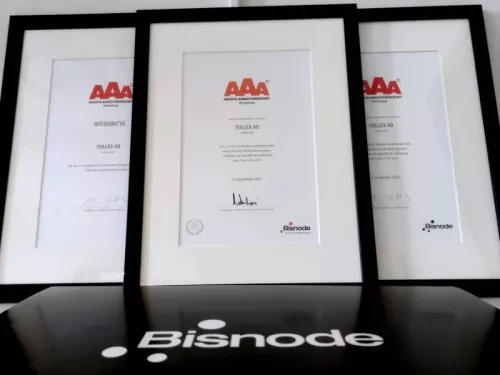

Sollex has been awarded AAA credit rating by Bisnode!

We are proud to announce that Sollex has been awarded AAA credit rating by Bisnode in 2024. This is the highest credit rating a company can receive and is an indication of our strong financial stability and reliability. Sollex has a turnover of 7.6 million, has been in business for 97 years and has good key figures that are significantly above the industry average.

We are proud to announce that Sollex has been awarded AAA credit rating by Bisnode in 2024. This is the highest credit rating a company can receive and is an indication of our strong financial stability and reliability. Sollex has a turnover of 7.6 million, has been in business for 97 years and has good key figures that are significantly above the industry average.

The AAA rating is the highest credit rating a company can receive and is a seal of quality that we are a safe and responsible business partner. Only about 2% of Swedish companies reach this level, making it a major milestone for Sollex.

We would like to thank our fantastic customers and partners for the trust you show us every day. We look forward to continuing to deliver knives and blades of the highest quality and to be a reliable partner for you, now and in the future.

2023-01-16

Sollex has defended the highest AAA credit rating. AAA is the highest credit rating a public company can receive. The requirements for the highest credit rating are that the company has a turnover of more than 2 million, has been in business for at least 10 years and has ratios that are substantially above the industry average.

Sollex is one of the very few Swedish limited companies with an AAA rating. Companies and staff are proud of our high credit rating. It is based on Bisnode's credit rating system which rates companies' ability to pay based on a set of decision rules.

All of the company's key metrics are above the industry median. Not everyone can get AAA which means Sollex does the best in the industry. So according to Solidity, we can beat our chest and be proud of our business.

General about AAA

In a financial context, the term 'Triple-A' (AAA) refers mainly to credit ratings. Credit ratings are assessments of the creditworthiness of entities, such as governments, municipalities or companies, in terms of their ability to meet financial obligations.

Here are some key points related to Triple-A credit ratings:

- Highest Credit Rating: AAA is the highest credit rating assigned by major rating agencies such as Moody's Investors Service, Standard & Poor's (S&P) and Fitch Ratings. It implies an extremely low credit risk. Entities with a AAA rating are considered to have the highest level of creditworthiness and are least likely to default on their debt obligations.

- Factors Considered: Rating agencies evaluate various factors to determine a credit rating, including financial stability, debt levels, cash flow, economic conditions, and quality of management. AAA-rated entities typically have strong financial positions, robust revenue streams, and prudent financial management.

- Investor Confidence: Investors often view AAA-rated securities as safe investments. These securities are considered low risk, and as a result, they typically offer lower interest rates or returns compared to lower-rated securities. Government bonds issued by financially stable countries, such as the United States or Germany, are often assigned AAA ratings.

- Impact on borrowing costs: Entities with AAA ratings can borrow money at lower interest rates than those with lower credit ratings. This is because investors require less compensation for the perceived lower risk of AAA-rated debt.

- Downgrades and Upgrades: A downgrade from AAA to a lower rating can have significant consequences. It can lead to higher borrowing costs, reduced investor confidence and increased scrutiny from financial markets. On the other hand, an upgrade to AAA is considered a positive signal and reflects improved financial health and creditworthiness.

Understanding credit ratings, including the importance of AAA ratings, is critical for investors, financial institutions, and policymakers as they assess and manage risks related to investing and lending.

2022-09-14

UC Gold Seal - Risk Class 5

Today Alexander from UC called and told us that Sollex this year again earned the UC Gold Shield: Risk Class 5 - Gold Seal. This means the highest level of creditworthiness. The UC Gold Shield is UC's highest award and means that the company handles everything from supplier invoices, customer and government contacts. All information is submitted on time.

According to UC, Sollex has a 0.08% risk prediction of bankruptcy or insolvency. According to Alexander, this means "true and good business spirit". The banks' assessment is that Sollex has the highest risk class 5. Level 5 with very low risk. Green numbers on everything. Profit, EBIT, cash flow and equity ratio are well above the industry index. UC's gold seal is a quality mark for an incredibly strong business. Above industry average on many points according to the tax authorities and the Riksbank.

2021-09-08

Sollex, supplier of knives and blades gets AAA rating.

This year again, Sollex AB has been awarded a AAA rating (highest credit rating) in the Bisnode credit rating system.

The other day, Steve from Bisnode called to tell us the good news. This year again Sollex receives Bisnode's AAA rating. In 1989, the Triple-A rating was created by Bisnode. It is Sweden's most well-known credit rating system. AAA is the highest rating for limited companies. The company must have been in existence for at least 10 years, have a turnover of more than SEK 2 million, have equity of at least SEK 200,000, have an auditor and key figures that are significantly above the industry average. Sollex AB has been AAA-rated since 2019-11-26. 585,000 of Sweden's 1.1 million companies are limited liability companies. 4.7% of these are rated AAA. However, only 2.4% maintain the AAA rating from the previous year as Sollex has done. This shows that Sollex AB is both well-established and well-managed.

2020-11-09

Sollex, supplier of knives and blades gets AAA rating (again).

Bisnode's Tripple A rating was founded in 1989 and is the most well known credit rating in Sweden. AAA is the highest rating for any Swedish company. Sollex AB has awarded AAA-rating since 2019-11-26, a rating that only 3% of companies in Sweden gets. This rating shows that Sollex AB is well established and well managed.

2019-12-17

Sollex, supplier of knives and blades has AAA rating.

Sollex AB has the highest credit rating AAA in Bisnode's credit rating system on December 17, 2019. This means that Sollex is creditworthy, stable, has satisfied customers and works with good suppliers. Bisnode's credit rating system analyze companies on 2,500 points related to finances, financial statements and ability to pay. For Sollex's part in particular, cash liquidity, balance liquidity and solvency have been strengthened, giving the highest credit rating. About 2% of Sweden's companies have the highest credit rating AAA and about 6% of Sweden's companies have an AA rating. 30% has no rating.

In the 1930s, there were 36 razor blades factories in Sweden. In 2020 there are only two left. In an extremely competitive market, we find it stimulating that Sollex received this fine credit rating.

Johan Falk

CEO Sollex AB

T: 0046 35 -15 75 00 #1

—